rsu tax rate ireland

The employee is taxed on restricted stock upon grant and on RSUs upon vesting may include personal assets tax. If youre looking for an rsu tax calculator.

Taxation Of Restricted Stock Units Rsus Carter Backer Winter Llp

Taxation of RSUs Share-settled RSUs You must pay Income Tax IT Universal Social Charge USC and Pay Related Social Insurance PRSI on the market value of these.

. Now that you know the basics of how rsus work you can now confidently use the rsu tax calculator below. Step 5 - Review Outputs of RSU Tax Calculator Once all the. RSUs are taxed just like if you received a cash bonus on the vesting date and used that money to buy your companys stock.

RSUs are taxed as ordinary income thus the rate that the recipient may pay can range from 10 to 37 depending on the recipients household income. At any rate RSUs are seen as supplemental income. Skip to main content.

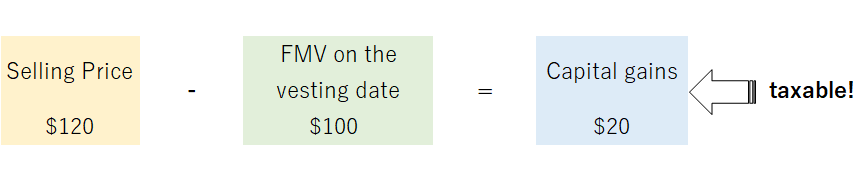

However since your tax withholding rate is 25 you owe 250 of your compensation to the government. RSUs can trigger capital gains tax but only if the. Cost of Shares10000 shares 1 10000.

RSUs are taxed at the ordinary income tax rate when they are issued to an employee after they vest and you own them. An RSU is a taxable emolument of the employment chargeable to income tax. That the holder may have been resident in Ireland at the time of the grant and during the vesting period.

RSUs chargeable to Income Tax under Schedule E are within the scope of the PAYE system. Value of Shares10000 shares 3 30000. A Restricted Stock Unit RSU is a grant or promise to an employeedirector to the.

Rsu Tax Calculator Ireland. Weve capped the state income tax rates at 15. Everything you need to know about Restricted Stock Units how RSUs are taxed and little-known RSU strategies to lower your tax bill in 2022.

A big note here you must enter a value even if the value is 0. Emily made an Exercised Share Profit of 20000. In the sell-to-cover method your employer will choose to sell.

The employee is subject to a flat tax of 15 percent on any net gain. What is the tax rate for an RSU. Also restricted stock units are subject.

The Ireland Capital Gains Tax Calculator is designed to allow free online calculations for residents and non-residents who have accrued income from capital gains in Ireland. The first 1270 of gains made by any individual in a tax year are exempt from. The value of over 1 million will be taxed at 37.

Of shares vesting x price of. When you become vested in your stock its fair market value gets taxed at the same rate as your ordinary income. The exact tax rate will.

Tax at vesting date is. Stamp duty rates of 1 to 2 apply for residential property but a 10 rate applies to the bulk purchase of 10 or more residential units situated in Ireland other than apartments. This is calculated as follows.

If all 100 shares were then sold at a later date for 200 per share your total gain would be 5000. Most companies will withhold federal income taxes at a flat rate of 22.

Capital Gains Tax On Shares In Ireland Money Guide Ireland

Company Shares Tax Returns Ireland Taxassist Accountants

Rsu Vs Stock Options What S The Difference Personal Capital

Don T Pay Tax Twice On Rsu Sales Parkworth Wealth Management

The Taxation Of Rsus In An International Context Sf Tax Counsel

Effective Income Tax Rates In Ireland Over Time Social Justice Ireland

Taxation In The Republic Of Ireland Wikipedia

Rsu Tax How Are Restricted Stock Units Taxed In 2022

Rsu Tax In Ireland What You Need To Pay File We Have The Expertise

Agenda Introduction U S Payroll Deposit Rules Managing Non U S Employment Tax Obligations Business Travelers Global Rewards Updates Questions And Contact Ppt Download

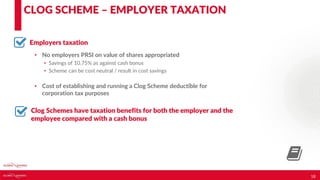

Tax Effective Share Plans In Ireland

/GettyImages-655242786-038f5688f69840899bc4f35415351106.jpg)

How Restricted Stock Restricted Stock Units Rsus Are Taxed

Budget 2020 What You Need To Know Cantwell Financial

Rsa Vs Rsu Everything You Need To Know Global Shares

Rsus A Tech Employee S Guide To Restricted Stock Units

Restricted Stock Unit Rsu Tax Calculator Equity Ftw

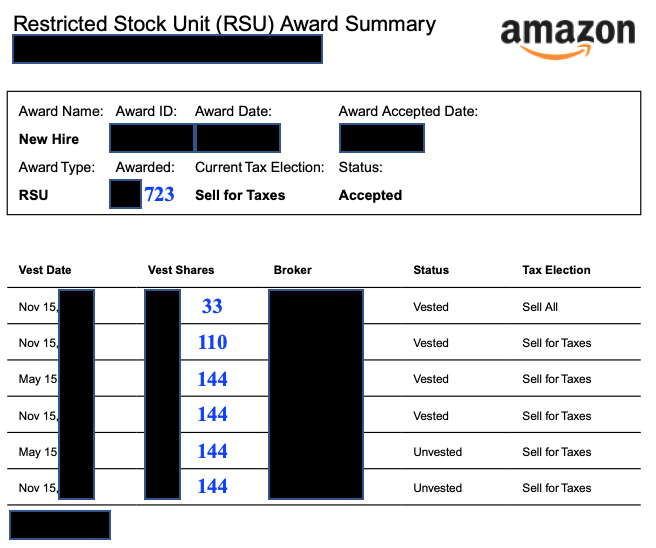

Demystifying Your Amazon Rsus Resilient Asset Management

Rsu And Tax In Ireland In 2021 Youtube

Filing A Tax Return In Japan For Share Based Compensation Rsus Employee Stock Options Employee Stock Purchase Plan From Overseas Parent Company Shimada Associates